GST On Mobile Phones Reduced in July 2023?

GST on Mobile Phones

Read this article if you are familiar with GST On Mobile Phones. If you want to discover more about utilizing, keep reading.

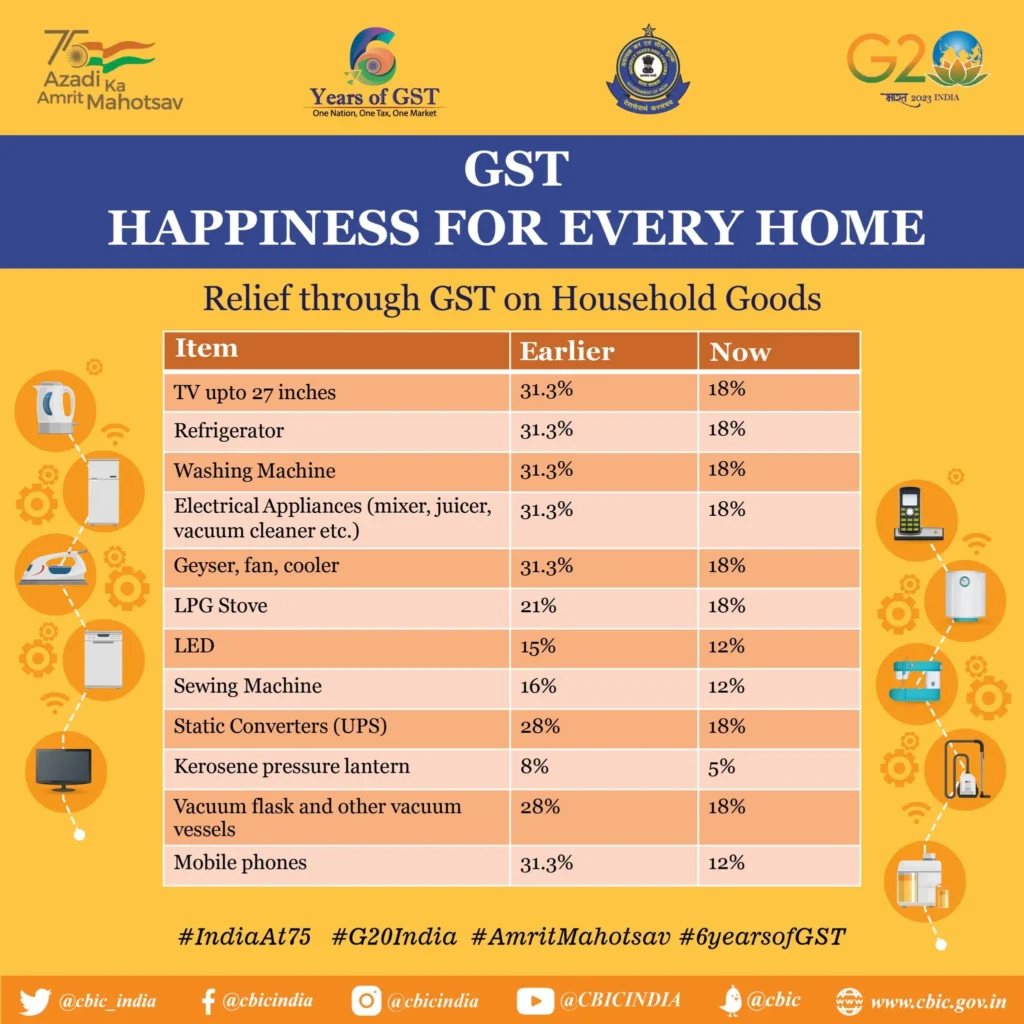

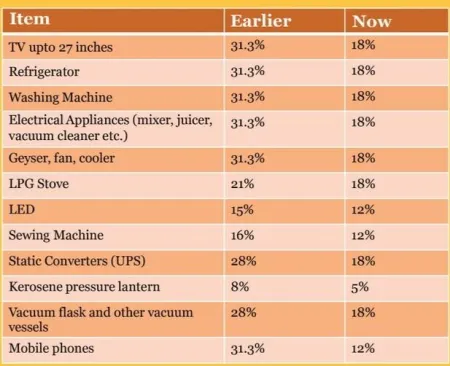

The Goods and Services Tax (GST) in India has been in place for six years, according to the Ministry of Finance. The Ministry of Finance’s official social media accounts posted an image demonstrating the advantages of the GST over the former system, which included several taxes and produced a bigger cumulative value. The snapshot shows the difference between the tax value before and after the introduction of GST.

A lower tax on mobile phones is one of the benefits of GST that are highlighted. Many internet users, including some well-known, individual social media influencers who rejoiced in the lowering of GST on mobile phones, were confused by the time of the post. The GST on TVs, home appliances, etc. is also depicted in the illustration.

Also, Read About Samsung Galaxy S23 FE Rumored Release Date – Price

However, is that actually the case? Sorry to burst your bubble, but the answer is no. India has not decreased the GST on mobile phones. The government imposed a 12% tax on mobile phones at the moment the GST was put into effect.

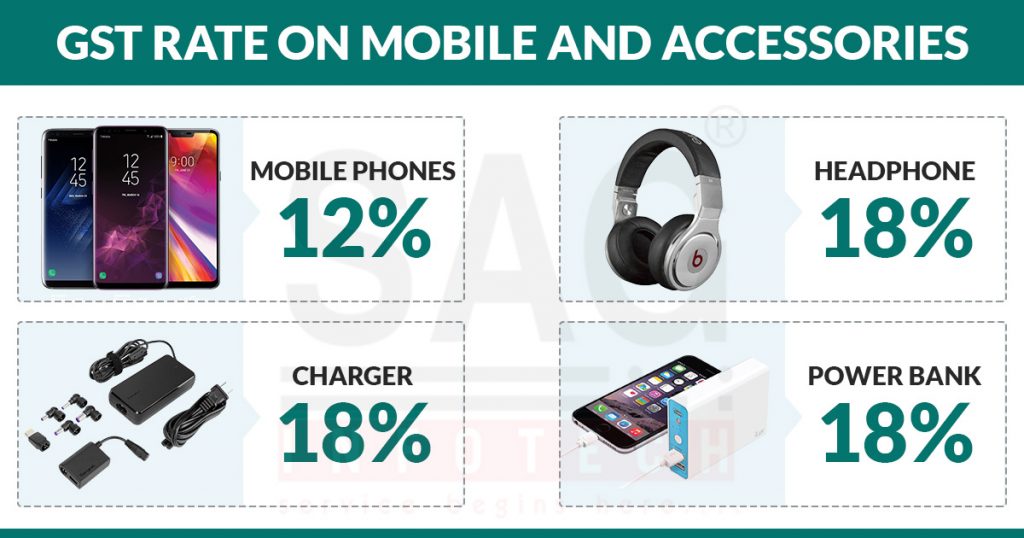

The Indian government later raised the GST on mobile phones and fixed it to 18% with effect from April 1, 2020, following the 39th GST Council meeting. Since then, corporations that make smartphones have been paying up to 18% GST on mobile phones—taxes that were passed to and removed from the pockets of consumers.

Also, Read

The GST on mobile phones was lowered to 12% during Budget 2023 by the government. However, consumers have yet to reap the rewards of the change because external factors like supply chain interruptions, the ongoing Russia-Ukraine conflict, and the fluctuating value of the Indian rupee against the US dollar have had little impact on component prices, logistics costs, etc. Consumers are now paying more, either directly or indirectly.

Phones did not offer the same value in terms of hardware and features if their cost stayed the same. On the other hand, phones with newer hardware than the previous model commanded much higher pricing.

Alao, Check it 1.43-Inch AMOLED Display, Bluetooth Calling, And Amazfit Pop 3R

Overall, there has been no change to the GST rate on mobile phones, which is still set at 12%. The most recent message, which contrasted taxes in the pre-and post-GST eras, appears to have misled a few users.

Frequently Asked Questions :

The new GST rate applicable on mobile phones is 18% as defined under HSN Chapter 3 (HSN Code 85171219). What are the GST rate categories applicable to different types of goods and services? The major GST rates that are applicable to different goods and services are 0%, 5%, 12%, 18%, or 28%.

2023 began with some key changes in the GST rates that were passed in Dec 2022. During that phase, the GST council also revised the GST rate list around some specific items in 2022. This includes corrections in the prevailing inverted tax structure and revisions for revenue augmentation.

Under HSN Chapter 71, the GST rate on gold jewelry, biscuits, or any semi-manufactured product is 3% (IGST or the sum of 1.5% CGST and SGST each). What is the applicable GST rate on mobile phones? The new GST rate applicable on mobile phones is 18% as defined under HSN Chapter 3 (HSN Code 85171219).

3 thoughts on “GST On Mobile Phones Reduced in July 2023?”