Bajaj Finance Share Price Analysis – Expert Insights

Bajaj Finance Share Price Analysis - Expert Insights

Introduction

Did you know about Bajaj Finance, if yes then this article is for you. We will be discussing Bajaj Finance. Read on for more.

Let’s talk about Bajaj Finance and its share price analysis. Bajaj Finance Limited is a non-banking financial company that provides various financial services such as personal loans, home loans, and business loans, among others.

The stock market is always buzzing with news of stocks going up and going down, but is Bajaj Finance really worth investing in?

In this article, we will be analyzing the share price of Bajaj Finance, looking at the fundamental and technical analysis of the stock, as well as factors that may affect its share price. Stay with us to know whether investing in Bajaj Finance is worth the risk.

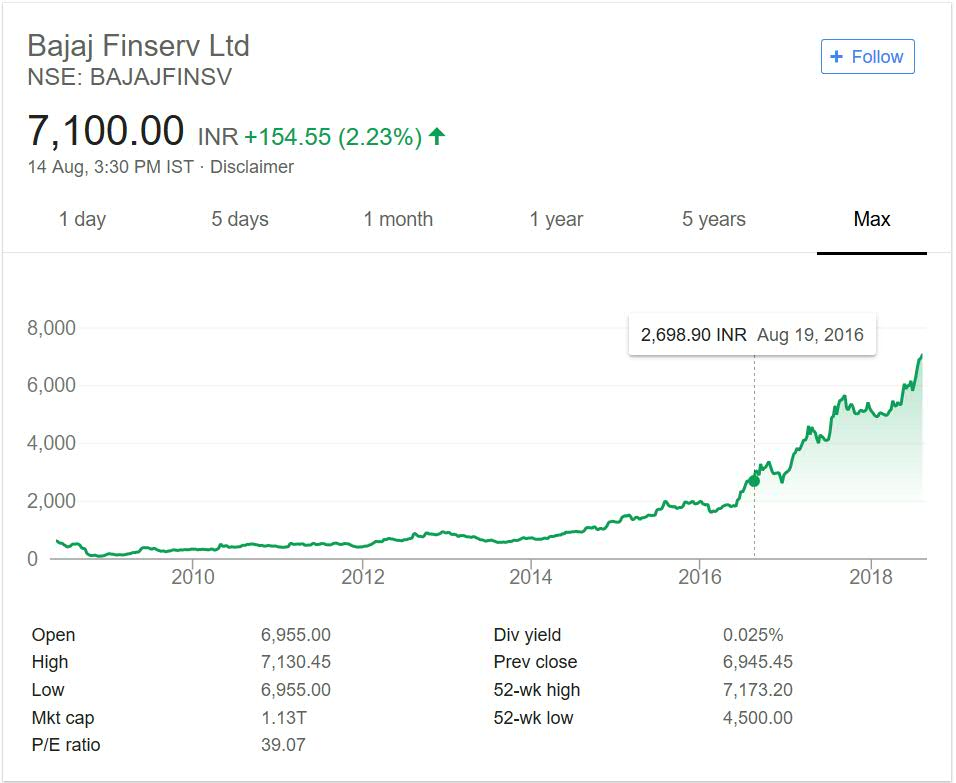

Fundamental Analysis of Bajaj Finance Share Price

Fundamental Analysis of Bajaj Finance Share Price: When it comes to fundamental analysis, it involves evaluating the company’s financial health by analyzing various financial ratios.

The Earnings per Share (EPS) of Bajaj Finance is INR 67.58, which shows that the company is generating profits and the shareholders are earning decent returns.

The Price-to-Earnings (P/E) ratio of Bajaj Finance is 22.72, which is higher than the industry average, indicating that the market has high expectations from the company. The Return on Equity (ROE) of Bajaj Finance is 14.98%, which is above the industry average but lower than its peers.

The Debt-to-Equity (D/E) ratio of Bajaj Finance is 2.23, which is high, indicating that the company has a considerable amount of debt., Bajaj Finance has a robust fundamental position, although it has a high D/E ratio.

The company’s strong EPS and P/E ratio reflect the market’s positive outlook towards the company. But, investors should keep an eye on the company’s high debt levels before making any investment decisions.

Technical Analysis of Bajaj Finance Share Price

When it comes to the technical analysis of Bajaj Finance share price, there are a few key indicators to keep an eye on. Moving averages are often used to identify trends in the stock price, with the 20-day and 50-day moving averages being particularly important.

The Relative Strength Index (RSI) is another widely used tool in technical analysis and can help to determine if a stock is overbought or oversold. Bollinger Bands provide an upper and lower boundary for the stock price, based on standard deviations from the moving average, and can be a useful tool for identifying volatility.

Finally, Fibonacci retracement levels can be used to identify potential support and resistance levels for the stock price based on key price points. Understanding these technical indicators can help investors make informed decisions when it comes to trading Bajaj Finance shares.

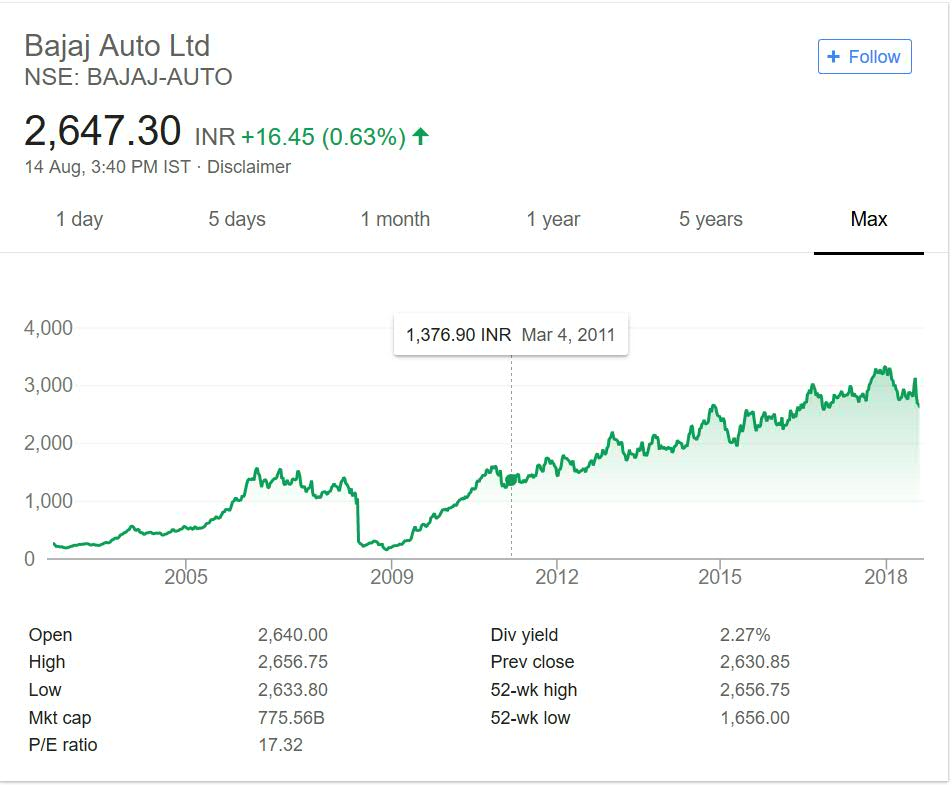

Comparative Analysis with Industry Peers

Comparative Analysis with Industry Peers: When it comes to the benchmarking of Bajaj Finance’s share price with its peers, HDFC Bank, ICICI Bank, and Kotak Mahindra Bank, we can see that Bajaj Finance is a clear winner.

EPS, Bajaj Finance’s EPS is the highest compared to its peers. Its P/E ratio is also impressive, proving to be the second-best among the four banks. Furthermore, when we look at the company’s debt-to-equity ratio, we can say that Bajaj Finance is at par with its peers.

Its ROE is also impressive, with the company leading the pack with a whopping 17.1 percent. It is evident that Bajaj Finance is the top-performing bank among its peers, and investing in its shares can be a great move for anyone looking to earn good returns.

Factors Affecting Bajaj Finance Share Price

When it comes to understanding Bajaj Finance share price and its movements, it’s essential to consider various factors that can affect it. Economic indicators like GDP growth rate, inflation rate, and interest rates can have an impact on the share price’s movement.

Any change in regulatory policies and government regulations can also have a bearing on the share prices. Corporate announcements like mergers and acquisitions and new product launches can also affect the share prices.

It’s crucial to keep a close watch on the financial performance of the company, as any significant change can significantly impact the share price of Bajaj Finance. Investing in the stock market is no joke, and it’s essential to have a sound understanding of the risks associated with it.

You must analyze the factors mentioned above before you make an informed investment decision in Bajaj Finance shares. Remember that the risks and rewards go hand in hand, and it’s essential to have a clear understanding of the potential risks and prepare accordingly.

Risks Associated with Investing in Bajaj Finance Shares

Investing in Bajaj Finance shares is not risk-free, and investors need to be aware of the potential downsides. Market risks are those that affect the performance of the stock market, such as economic fluctuations or political instability.

Company-specific risks, so are unique to Bajaj Finance and include factors like regulatory changes or negative corporate news.

But, don’t let these risks scare you off from investing. As with any investment, there is the potential for both gains and losses.

By conducting a thorough analysis and staying informed about market trends and news, investors can cut their risks and make informed decisions. Just remember, the greater the risk, the greater the potential reward.

Also read about Discover Homary: Your One-Stop Home Decor Destination.

Frequently Asked Questions

A: Bajaj Finance is a leading non-banking financial company (NBFC) based in India. It offers a wide range of financial products and services, including consumer finance, retail lending, commercial lending, wealth management, insurance, and asset management.

A: Bajaj Finance offers various types of loans to individuals and businesses. These include personal loans, home loans, business loans, loan against property, professional loans, gold loans, and vehicle loans. They also provide consumer durable loans for purchasing electronics, appliances, and lifestyle products.

A: The eligibility criteria for obtaining a loan from Bajaj Finance may vary depending on the type of loan and specific requirements. Generally, factors such as income, employment status, credit history, age, and residence stability are considered. It’s advisable to visit their website or contact Bajaj Finance directly for detailed information on eligibility criteria for a specific loan product.

Conclusion

In a nutshell, the fundamental and technical analysis of Bajaj Finance shares showed promising results.

But, the comparative analysis with peers reflected stiff competition, and external factors such as regulatory changes and economic indicators pose risks for investment.

Experts suggest a cautious approach, keeping in mind the market and company-specific risks. That being said, if there is a long-term investment horizon, Bajaj Finance shares could yield good returns.