The Euro: A Brief History and Overview | Do It Something

What Is EURO

Introduction

This post is for you if you are familiar with The Euro. For more information on the subject of Using the Euro, keep reading.

Also, read about LG TV Keeps Disconnecting from Wi-Fi.

Euro is the official currency of the European Union (EU) and is used by 19 out of the 27 EU member countries. It was introduced in 1999 as a digital currency and became physical currency in 2002.

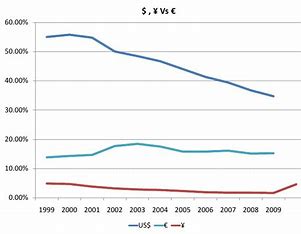

The euro is the second most traded currency in the world after the US dollar and is managed by the European Central Bank (ECB) based in Frankfurt, Germany.

The euro is represented by the symbol € and is divided into 100 cents. The eurozone, which refers to the 19 countries that use the euro, has a combined population of over 343 million people.

Eurozone

Eurozone is a term used to describe the group of 19 European Union member countries that have adopted the euro as their official currency.

These countries are Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, and Spain.

The eurozone was created to ease economic integration and growth among its member countries.

It allows for the free movement of goods, services, capital, and people within its borders, which makes doing business and travelling between member countries easier.

Yet, the eurozone also faces challenges such as managing fiscal policies, ensuring economic stability, and addressing issues of economic inequality among member states.

The European Central Bank (ECB) handles managing the eurozone’s monetary policy and ensuring price stability.

The eurozone has played a significant role in the global economy, as it is the second largest economy in the world after the United States.

Its economic performance can have significant impacts on the rest of the world, particularly during periods of economic uncertainty.

Value and Exchange Rates

The value of the euro is determined by its exchange rate, which is the price of one currency another currency.

The exchange rate of the euro can be influenced by various factors, such as interest rates, inflation, economic growth, political stability, and global trade patterns.

The European Central Bank (ECB) plays a key role in managing the value of the through its monetary policy decisions.

The ECB can influence the value of the euro by adjusting its interest rates, which affects the demand for the euro in international currency markets.

The exchange rate of the also impacts trade between countries that use different currencies.

For example, if the euro appreciates in value relative to another currency, then it becomes more expensive for businesses and consumers to sale goods and services from countries using that currency.

Conversely, if the depreciates in value, then it becomes cheaper for businesses and consumers to sale goods and services from countries using that currency.

Exchange rates are constantly fluctuating, and they can have a significant impact on the global economy. Traders and investors watch exchange rates closely to identify trends and make informed decisions about buying and selling currencies.

Euro Banknotes and Coins

Euro banknotes and coins are physical currency used in the Eurozone to make transactions. The banknotes and coins are designed to be easy to recognize and differentiate from one another, as well as being secure against counterfeiting.

There are seven denominations of banknotes, ranging from €5 to €500. Each banknote has a unique color and size, with the higher denominations being larger in size.

The banknotes also feature various architectural styles from different periods of European history, such as Romanesque and Baroque.

Euro coins come in eight denominations: 1 cent, 2 cents, 5 cents, 10 cents, 20 cents, 50 cents, €1, and €2.

Each denomination has a unique size, weight, and design, with the larger denominations being larger in size. The coins feature various designs related to European culture, history, and art.

Both the banknotes and coins have several security features, such as watermarks, holograms, and special printing techniques, to prevent counterfeiting. Additionally, the banknotes and coins are designed to be durable and long-lasting, with a lifespan of several years.

Euro banknotes and coins are widely accepted throughout the Eurozone, and can also be exchanged for other currencies at banks and currency exchange offices.

Impact on International Trade

The Euro has had a significant impact on international trade since its introduction in 1999. Here are some ways the Euro has harmed international trade:

- Reduced Transaction Costs: The Euro has reduced transaction costs associated with currency exchange, as businesses no longer have to exchange many currencies to do business with different European countries. This has made it easier and cheaper for businesses to engage in cross-border trade within the Eurozone.

- Increased Trade and Investment: The Euro has facilitated increased trade and investment among Eurozone countries, as businesses and investors are more likely to engage with countries that have a common currency. The Euro has also made it easier for businesses to engage in joint ventures and mergers and acquisitions across borders.

- Enhanced Competitiveness: The Euro has enhanced the competitiveness of businesses within the Eurozone, as businesses no longer have to deal with currency fluctuations and uncertainties associated with exchange rates. This has allowed businesses to focus more on improving their products and services, rather than worrying about currency risks.

- Influenced Global Currency Markets: The has become the second most traded currency in the world after the US dollar. The Euro’s value and exchange rates can influence global currency markets, and changes in the Euro’s value can impact international trade and investment.

- Challenges for Non-Eurozone Countries: The Euro’s introduction has presented challenges for countries that are not part of the Eurozone, as they have to deal with exchange rate fluctuations and uncertainties when trading with Eurozone countries. This can make it more difficult and costly for businesses in non-Eurozone countries to compete with Eurozone businesses.

How To Use euro?

The euro can be used to payment for goods and services within the Eurozone countries that have adopted the currency. Here are some ways to use the:

- Cash: Banknotes and coins can be used to make purchases at stores and businesses that accept the currency. Cash can also be withdrawn from ATMs using a debit or credit card.

- Debit and Credit Cards: Denominated debit and credit cards can be used to make purchases at stores and businesses that accept card payments. These cards can also be used to withdraw cash from ATMs.

- Bank Transfers: Denominated bank transfers can be used to send money within the Eurozone or to countries outside the Eurozone that accept the euro. Bank transfers can be initiated online, through mobile banking apps, or by visiting a bank branch.

- Online Payment Systems: Online payment systems, such as PayPal, can be used to make euro-denominated payments for goods and services online.

It is important to note that some businesses may not accept cash payments for large transactions or may not accept foreign cards, so it is always a good idea to check before making a sale. Additionally, when using debit or credit cards, it is important to check for any foreign transaction fees that may be applied by the card issuer or bank.

Frequently Asked Questions

No, a digital euro would be complementing cash, not replacing it. Cash will continue to be available in the euro area. A digital euro would function alongside cash as a response to consumers’ evolving demand to pay digitally, in a fast and secure way.

A digital euro should not have negative consequences for the financial sector. To do this, we will take into account the following requirements: i) a digital euro should be mainly used as a means of payment and not become an instrument for financial investments, and ii) supervised intermediaries should be involved in the handling of a digital euro.

No – a digital euro would be just another way to make payments with the euro, our single currency, in Europe. It would be convertible one-to-one with banknotes. A digital euro would respond to citizens’ and firms’ developing preference for digital payments.

Conclusion

This was our guide on How to Use Euro.

Has had a significant impact on international trade, reducing transaction costs, increasing trade and investment, enhancing competitiveness, influencing global currency markets, and presenting challenges for non-Eurozone countries.

Euro can be used to payment for goods and services through cash, debit and credit cards, bank transfers, and online payment systems.

The Euro’s value and exchange rates are influenced by various factors, and the European Central Bank plays a key role in managing the currency’s value through its monetary policy decisions.