How to Start Your | Trading Journey

How to Start Your Trading Journey

Understanding the basics of trading

If you are familiar with How to Start Your Trading you should read this article. Continue reading if you want to learn more about utilizing.

Sure, here are some key points to understand when it comes to the basics of trading:

- Trading is the process of buying and selling assets such as stocks, currencies, commodities, or derivatives in financial markets.

- Traders aim to make a profit by buying assets when their prices are low and selling them when prices are high.

- There are two main types of analysis that traders use to identify opportunities: technical analysis, which involves using charts and indicators to analyze past price movements, and fundamental analysis, which involves analyzing economic and financial data to identify potential market trends.

- Trading can be done through a variety of platforms, including online brokerage firms, banks, or through traditional stockbrokers.

- The risks of trading include the possibility of losing money, as well as the potential for volatility and uncertainty in the markets.

- Traders should always have a clear understanding of the assets they are

Deciding what to trade

When deciding what to trade, there are several factors to consider. Here are some subheadings that can help you make an informed decision:

- Stocks: Understanding the stock market and choosing stocks to trade

- Evaluating a company’s financial health

- Analyzing stock performance and market trends

- Understanding market capitalization and types of stocks

- Forex: Exploring the world of foreign exchange trading

- Understanding currency pairs and exchange rates

- Analyzing market trends and economic indicators

- Using Leverage and Margin in forex trading

- Options: An introduction to trading options

- Understanding the basics of options trading

- Different types of options and their uses

- Developing a trading strategy using options

- Futures: Trading commodities and other futures contracts

- Understanding how futures contracts work

- Analyzing commodity prices and market trends

- Using Leverage and Margin in futures trading

- Cryptocurrencies: Investing in digital assets

- Understanding blockchain technology and cryptocurrencies

- Analyzing market trends and volatility

- Assessing risk and choosing a cryptocurrency to invest in.

Remember, each type of trading has its own risks and benefits, so it’s important to carefully consider your goals and risk tolerance before making a decision.

Choosing a trading platform and broker

Choosing a trading platform and broker is an important step in starting your trading journey. Here are some key factors to consider when making this decision:

- Security and Regulation: Check if the trading platform and broker are regulated and licensed by a reputable regulatory authority. This helps ensure the safety of your funds and personal information.

- Trading Costs: Look at the trading fees, commissions, spreads, and other costs associated with trading on the platform. Compare these costs with other platforms to ensure you’re getting the best value.

- User-Friendliness: Make sure the platform is easy to navigate and use. Check the platform’s interface and tools to ensure they’re intuitive and provide the information you need.

- Trading Tools and Features: Look for trading tools and features that can help you make better trading decisions, such as charting tools, technical analysis indicators, and news feeds.

- Trading Instruments: Consider the variety of instruments available for trading on the platform, such as stocks, currencies, commodities, and cryptocurrencies. Choose a platform that offers the instruments you’re interested in trading.

- Customer Service and Support: Look for a platform and broker that offers good customer service and support. You want to be able to get help when you need it.

- Reputation and Reviews: Check the platform and broker’s reputation and reviews from other traders. Look for feedback on reliability, speed of execution, and quality of customer support.

By considering these factors, you can choose a trading platform and broker that meets your needs and helps you achieve your trading goals.

Also, Check- Business Plan Template

Creating a trading plan and setting goals

Creating a trading plan and setting goals is an essential parts of starting your trading journey. Without a plan, you may be more likely to make impulsive decisions that could lead to losses. Here are some tips for creating a trading plan and setting goals:

- Determine your risk tolerance: Before you start trading, it’s important to determine how much risk you’re comfortable taking on. This will help you decide what types of trades to make and how much money to invest.

- Set realistic goals: When setting trading goals, it’s important to be realistic. Start with small, achievable goals, such as making a certain percentage return on your investment over a certain period of time.

- Choose a trading strategy: There are many different trading strategies to choose from, including trend following, swing trading, and day trading. Research different strategies and choose one that aligns with your goals and risk tolerance.

- Develop a trading plan: Your trading plan should include details such as which markets to trade, which trading strategy to use, and how much money to invest in each trade. It should also include rules for when to enter and exit trades.

- Monitor and evaluate your performance: Regularly monitor your performance and evaluate how well you’re meeting your trading goals. If you’re not meeting your goals, adjust your trading plan as needed.

- Stay disciplined: Following your trading plan and sticking to your goals can be difficult, especially when emotions are involved. Stay disciplined and avoid making impulsive decisions.

By creating a trading plan and setting realistic goals, you can help increase your chances of success as a trader.

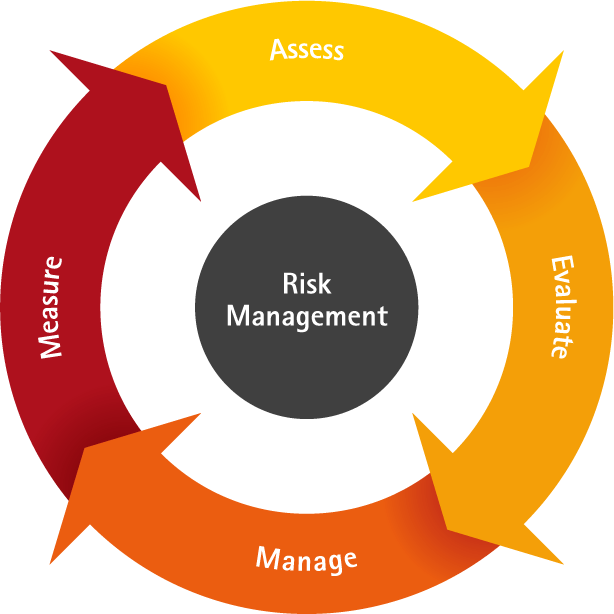

Managing risk and developing a risk management strategy

Managing risk and developing a risk management strategy is a critical aspect of trading that can help traders to minimize potential losses and preserve their trading capital. Here are some tips for managing risk and developing a risk management strategy:

Also,Read

- Set a stop loss: A stop loss is an order to sell a security if it drops to a certain price level. Setting a stop loss can help you limit your losses and prevent them from spiraling out of control.

- Diversify your portfolio: Diversification can help you spread your risk across different assets and reduce your exposure to any one particular security or market.

- Use leverage wisely: Leverage can amplify your gains, but it can also magnify your losses. Make sure you understand the risks involved with leverage and use it wisely.

- Know your risk tolerance: Your risk tolerance is the amount of risk you’re willing to take on in pursuit of higher returns. How to Start Your Trading Make sure you have a clear understanding of your risk tolerance and adjust your trading strategy accordingly.

- Keep an eye on market volatility: Volatility can be a double-edged sword. While it can present opportunities for profit, it can also increase the risk of losses. Keep an eye on market volatility and adjust your risk management strategy accordingly.

- Monitor your trades: Regularly monitoring your trades can help you identify potential risks and take action to mitigate them.

- Use position sizing: Position sizing is the practice of adjusting the size of your trades based on your risk tolerance and the size of your trading account. Using position sizing can help you manage risk and preserve your capital.

By following these tips and developing a risk management strategy that works for you, you can help minimize potential losses and maximize your chances of success as a trader.

Also, Check- Ideas For Business

Developing a trading strategy and testing it out

Developing a trading strategy and testing it out is a crucial step in starting your trading journey. Here are some tips on how to develop and test a trading strategy:

Also, Read

- Identify your trading goals and objectives: Before you start developing a trading strategy, you need to identify your goals and objectives. What do you want to achieve through trading? What kind of trader do you want to be? Are you looking to make a steady income or are you interested in higher-risk, higher-reward trades?

- Choose your trading style: There are several trading styles to choose from, including day trading, swing trading, and position trading. Each style has its own strengths and weaknesses, so it’s important to choose the one that fits your goals and personality.

- Conduct research and analysis: To develop a successful trading strategy, you need to conduct research and analysis on the markets you plan to trade in. This includes analyzing market trends, economic indicators, and news events that could impact your trades.

- Develop your trading plan: Based on your goals, objectives, and analysis, you can develop a trading plan that outlines your entry and exit points, risk management strategies, and position sizing.

- Backtest your strategy: Once you’ve developed your trading plan, you should backtest it using historical market data. How to Start Your Trading This will give you an idea of how your strategy would have performed in the past and can help you identify potential weaknesses.

- Paper trade your strategy: After backtesting, you should paper trade your strategy by making simulated trades without risking real money. How to Start Your Trading This will help you refine your strategy and gain experience without incurring losses.

- Evaluate your results: After paper trading, evaluate your results and make adjustments as necessary. You should also track your performance over time to identify trends and areas for improvement.

Remember, developing a successful trading strategy takes time and effort. Be patient and keep learning as you go.

Starting small and gradually building up experience and confidence

Great! Here are some subheadings for starting small and gradually building up experience and confidence:

- Starting with a demo account

- Practicing with small trades

- Learning from successes and failures

- Keeping track of progress and trading records

- Gradually increasing trade sizes as confidence grows

- Finding a trading community or mentor for support and feedback

- Exploring different trading strategies and styles

- Keeping emotions in check and avoiding impulsive decisions

- Focusing on the long-term and not getting discouraged by setbacks

- Celebrating small wins and maintaining a positive attitude.

Evaluating performance and making adjustments

Evaluating your performance and making adjustments is a crucial step in becoming a successful trader. Here are some key points to consider:

Also, Read-Small Business Digital Marketing Consultant

- Keep track of your trades: The first step in evaluating your performance is to keep track of all your trades. This includes the instruments you traded, the entry and exit points, the trade duration, and the profit or loss made.

- Analyze your trades: Once you have a record of your trades, it’s important to analyze them to identify patterns and trends. This will help you understand what worked and what didn’t.

- Assess your risk management: Risk management is a key component of successful trading. Assess how you managed risk in each trade and whether there were any areas where you could improve.

- Evaluate your trading strategy: Take a close look at your trading strategy and evaluate whether it was effective. Consider whether you followed your strategy consistently and whether it was appropriate for the market conditions.

- Make adjustments: Based on your analysis, make any necessary adjustments to your trading plan. This could include refining your strategy, adjusting your risk management approach, or modifying your goals.

- Continuously monitor your performance: Trading is an ongoing process, so it’s important to continuously monitor your performance and make adjustments as needed. This will help you improve over time and achieve greater success as a trader.

Continuing to learn and improve as a trader.

Sure, here are some additional subheadings that could be included under “Continuing to learn and improve as a trader”:

- Keeping a trading journal to track progress and identify areas for improvement

- Learning from successful traders and seeking mentorship

- Participating in trading communities and forums to gain insights and connect with other traders

- Using backtesting and data analysis to refine trading strategies

- Regularly reviewing and updating your trading plan to adapt to changing market conditions

- Staying disciplined and avoiding emotional decision-making

- Seeking out educational resources, such as books, courses, and webinars, to deepen your knowledge of trading principles and techniques

- Remaining adaptable and open to new approaches and ideas as you continue to grow as a trader.

Frequently Asked Questions :

I believe that the best way to show a beginner trader’s journey is by showing it from first person perspective. Here is a real journey from a real person, who took the courage to share it with the trading world. No one has done that before, so hats down to the courage of this trader and his inspirational story!

Trading Courses- the path from beginner to intermediate trader. The journey finally starts to take shape At that point of my beginner trader’s journey I started to trade the strategies that were taught to me in the last trading course. Unfortunately, the lack of discipline combined with my fears made me fail again.

What you can do, though, is give yourself the best possible start by building the right foundations and begin acquiring valuable knowledge at the outset. How does trading work? You start trading by opening an account with a broker and downloading a trading platform such as MetaTrader 4 (MT4).

You can’t learn everything you need to know at once – trading is a long-term journey. What you can do, though, is give yourself the best possible start by building the right foundations and begin acquiring valuable knowledge at the outset. How does trading work?

Conclusion

starting a trading journey can be a challenging yet rewarding endeavor. It requires a solid understanding of the basics of trading, careful planning and risk management, and a commitment to ongoing learning and improvement. By following the steps outlined in this guide, including choosing what to trade, selecting a trading platform, developing a trading plan and strategy, managing risk, and continuing to learn and adapt over time, you can lay a solid foundation for a successful trading career.

Remember to stay disciplined, avoid emotional decision-making, and seek out support and guidance as needed. With persistence, patience, and a willingness to learn, you can embark on a fulfilling and potentially lucrative trading journey.

This article should have How to Start Your Trading Please let us know in the comments area if you have any questions.