PhonePe Now Lets Users Pay Income Tax Directly From Its App

PhonePe Now Lets Users Pay Income Tax

If you are familiar with PhonePe Now Lets Users Pay Income Tax, read this article. Continue reading if you want to learn more about utilizing.

Advance tax and self-assessment payments can be made through PhonePe.

For paying taxes, PhonePe accepts credit cards as well as UPI.

Both individuals and corporations can use the new PhonePe tax payment option.

One of the most popular payment apps in India, PhonePe supports UPI, recharges, bill payments, insurance, and other services. The business has just unveiled a brand-new feature geared towards the nation’s tax-paying people. In order to offer a seamless and effective payment experience, it has incorporated native support for income tax payments. You should be aware of the following.

PhonePe’s Tax Payment Option

Within its iOS and Android apps, PhonePe has added a new income tax payment feature. It provides taxpayers with yet another way to make timely income tax payments and enjoy a better user experience.

The new feature of the app is accessible to both individuals and companies and is powered by PayMate, a well-known digital B2B payment and service provider.

Also, Read Unleashing the Power of EDM

With just a few touches, self-assessment and advance tax payments can be made. For the payment of income taxes, UPI and credit cards are supported. PhonePe Now Lets Users Pay Income Tax According to PhonePe, credit card users will receive a 45-day interest-free period and, depending on their bank, reward points for payments.

“At PhonePe, we are committed to continuously enhancing our offerings to meet the evolving needs of our users,” stated Niharika Saigal, Head of Bill Payments and Recharge Business. We are excited to announce the release of our newest feature, the ease of filing taxes directly through the PhonePe app.

Tax payment can frequently be a difficult and time-consuming process, but PhonePe is now providing its users with a simple and safe option to complete their tax duties. Since we have now made the process quick and easy, we think that this will drastically change the way our users pay their taxes.

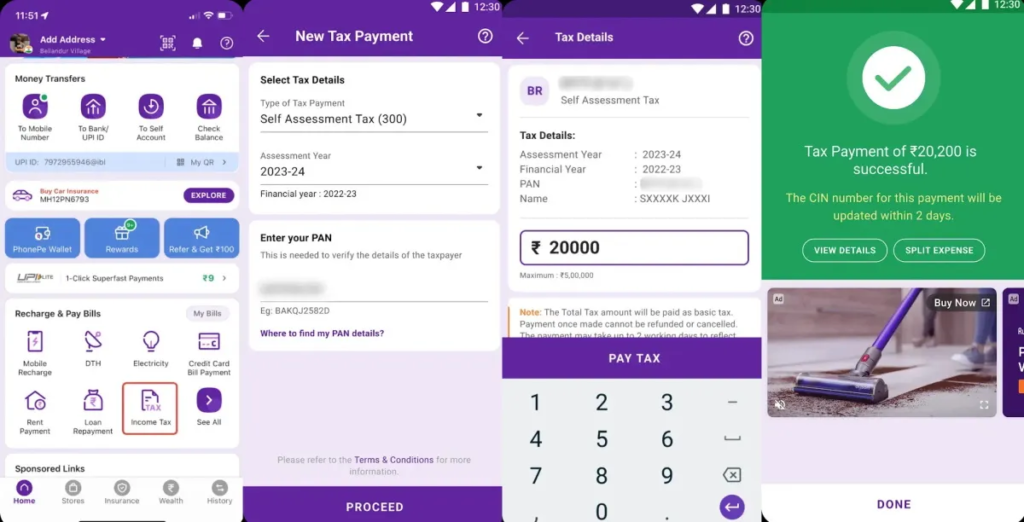

How to Use PhonePe to Pay Income Tax?

- Open the PhonePe app and search under the Recharge & Pay Bills area for the Income Tax option.

- Select the assessment year and tax payment type (either self-assessment or advance tax).

- To verify, enter the 10-digit PAN card number.

- Proceed to the payment page after entering your tax amount.

- Pick your desired payment method—credit card or UPI.

- Watch for the app’s message confirming a successful payment.

A Unique Transaction Reference (UTR) number will be provided to users by PhonePe within one day of a successful tax payment, the company claims. The arrival of the tax payment challan number could take up to two working days.

Also, See 3snet Review [2023] Do It Something

It’s crucial to remember that the new PhonePe feature is exclusively intended for paying taxes. You can file income tax returns (ITR) online at the Income Tax Department website, but not using PhonePe. The financial year 2022–2023’s ITR filing deadline is July 31, 2023.

Frequently Asked Questions :

Step 1: Open the PhonePe app homepage and tap on the ‘Income tax’ icon Step 2: Select the type of tax you would like to pay, the assessment year, and PAN Card details Step 3: Enter the total tax amount and pay using the preferred mode of payment

The feature allows taxpayers, both individuals and businesses, to pay self-assessment and advance tax directly from within the PhonePe app, thus eliminating the need to log in to the tax portal. “PhonePe has partnered with PayMate, a leading digital B2B payments and service provider, to enable this feature.

There should be no options shown to the user, as soon as he clicks on Pay, automatically PhonePe Payments page should automatically open. Use a separate URL for your store in the PhonePe Apps Platform. Identify user agent as ‘PhonePe’ sent in PhonePe webview.