Quicken Review for 2023: Features & Pricing, Pros & Cons

Quicken

Quicken

Are you familiar with Quicken? If so, you should read this article. We’ll talk about Quicken. See more below.

Is a personal finance management software developed by Quicken Inc. that allows users to track their financial transactions, create budgets, and manage investments. Quicken is available in various editions, including Quicken Starter Deluxe, Quicken Premier, and Quicken Home & Business.

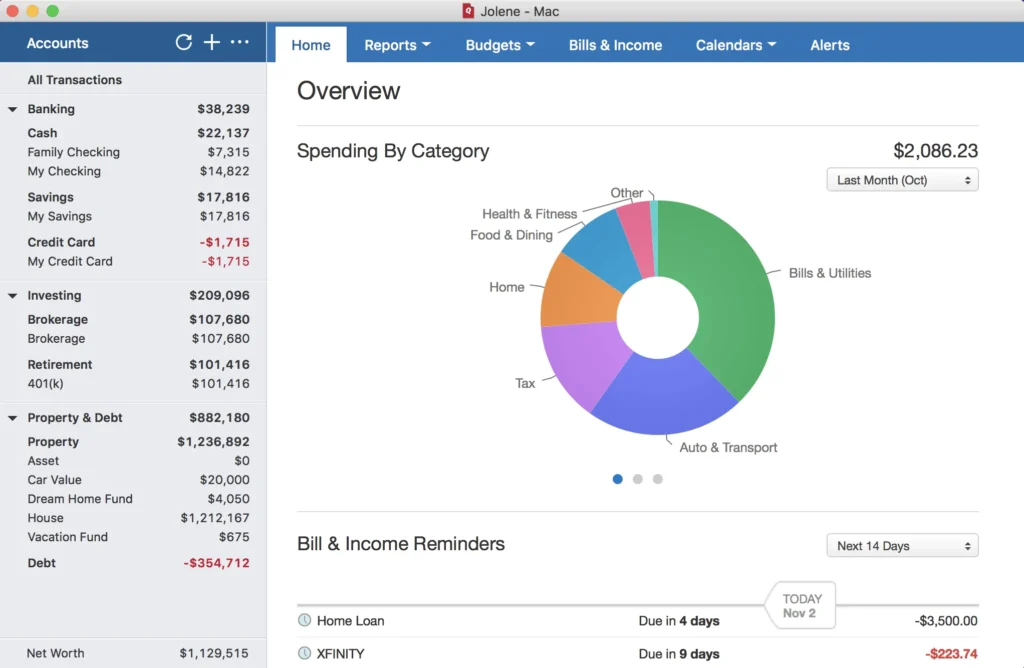

Quicken can help you manage your finances by allowing you to connect your financial accounts, such as bank accounts, credit cards, and investments, to the software. It can then automatically categorize and track your transactions, giving you a real-time snapshot of your financial health. You can also use Quicken to create a budget, track your bills and payments, and check your investments.

If you have any specific questions about or need help using the software, feel free to ask and I’ll do my best to assist you.

What is Quicken

Quicken is a personal finance management software that helps individuals and small businesses manage their finances. It is developed and marketed by Inc., which is a subsidiary of the software company, Intuit. can be used to track financial transactions, create budgets, check investments, pay bills, and generate reports.

With, you can connect your financial accounts, such as bank accounts, credit cards, and investment accounts, to the software and download transactions automatically. The software can then categorize and track your spending, giving you a real-time view of your financial situation. You can also use Quicken to create a budget and track your progress towards your financial goals.

Quicken is available in several editions, including Starter, Quicken Deluxe, Quicken Premier, and Quicken Home & Business. Each edition comes with different features and pricing, depending on your needs.

Quicken Key Features

Quicken offers a range of features to help you manage your finances effectively. Here are some of the key features of Quicken:

- Account linking: Quicken allows you to link all your financial accounts, including bank accounts, credit cards, investment accounts, loans, and retirement accounts, so you can view all your transactions in one place.

- Automatic transaction download: can automatically download transactions from your linked accounts, so you don’t have to enter them manually.

- Categorization and tracking: Quicken can categorize your transactions automatically, making it easy to track your expenses and income.

- Budget creation and tracking: You can create a budget in and track your spending against it to help you stay on track with your financial goals.

- Bill tracking and payment: can track your bills and remind you when they are due. You can also use the software to make payments directly from your linked accounts.

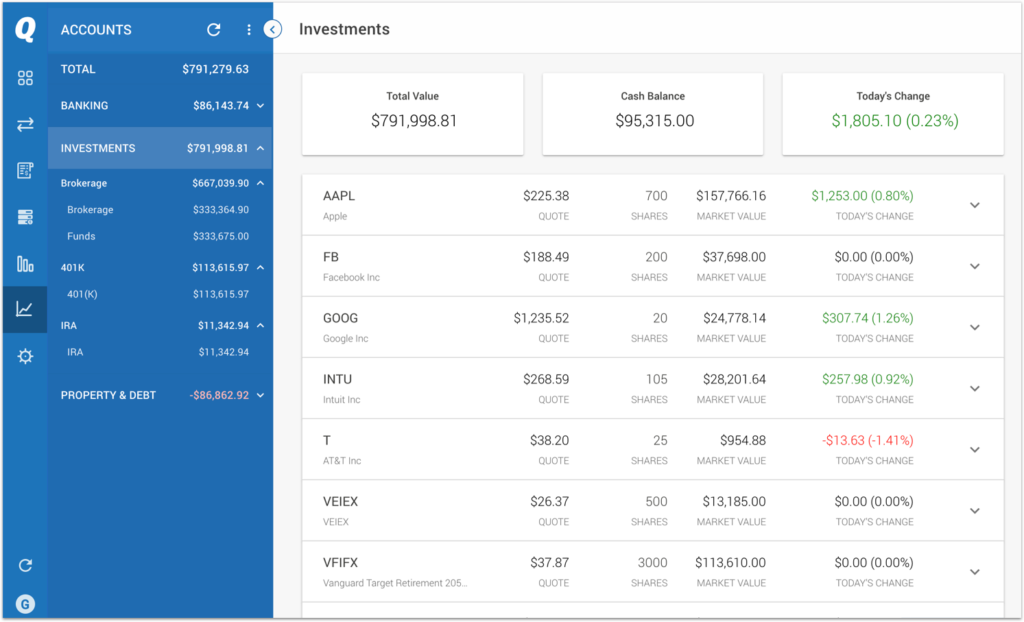

- Investment tracking: Quicken allows you to track your investment performance, view your asset allocation, and analyze your portfolio.

- Reporting: Quicken can generate a range of reports, including budget reports, income and expense reports, and investment reports.

- Mobile app: Quicken offers a mobile app that allows you to access your financial information on the go.

These are just some of the key features of. The specific features available to you will depend on the edition of Quicken you choose.

Web & Mobile Access

Quicken offers web and mobile access to help you manage your finances on the go. With web and mobile apps, you can access your financial information from anywhere, at any time. Here’s a closer look at how it works:

Web Access:

Quicken’s web access is available through any web browser. Once you’ve set up your account and linked your financial accounts, you can log in to the website and view your financial information. You can view your account balances, track your transactions, create and manage budgets, and generate reports. The web interface is designed to be easy to use, and it offers many of the same features as the desktop version of Quicken.

Mobile Access:

Quicken’s mobile app is available for iOS and Android devices. The app allows you to manage your finances on the go, so you can stay on top of your money no matter where you are. With the mobile app, you can view your account balances, track your transactions, create and manage budgets, and pay bills. The app also offers alerts and notifications, so you can stay on top of your financial activities. The mobile app is designed to be user-friendly, with an intuitive interface and easy navigation.

In summary, Quicken’s web and mobile access allows you to access your financial information and manage your finances on the go, giving you the flexibility and convenience to stay on top of your money no matter where you are.

Quicken for Windows Features

Here is a table of some of the key features available in Quicken for Windows, broken down by edition:

| Feature | Starter | Deluxe | Premier | Home & Business |

| Account linking | Yes | Yes | Yes | Yes |

| Automatic transaction download | Yes | Yes | Yes | Yes |

| Categorization and tracking | Yes | Yes | Yes | Yes |

| Budget creation and tracking | Yes | Yes | Yes | Yes |

| Bill tracking and payment | Yes | Yes | Yes | Yes |

| Investment tracking | Yes | Yes | Yes | |

| Investment performance analysis | Yes | Yes | Yes | |

| Asset allocation analysis | Yes | Yes | Yes | |

| Loan tracking | Yes | Yes | Yes | |

| Rental property management | Yes | Yes | ||

| Business accounting features | Yes | |||

| Customizable reports | Yes | Yes | Yes | Yes |

| Mobile app | Yes | Yes | Yes | Yes |

| Priority customer support | Yes | Yes |

Note: This table is not exhaustive and only includes some of the key features available in each edition of Quicken for Windows. The specific features available to you may depend on the version and edition of Quicken you choose.

Simplifi by Quicken

Simplifi by Quicken is a personal finance management app designed to help individuals manage their finances more easily. It is developed by Quicken Inc., the same company that develops the Quicken desktop software.

Simplify is designed to be simple and easy to use, with a clean and intuitive interface. It allows you to link your financial accounts, such as bank accounts, credit cards, and investment accounts, to the app, so you can see all your financial information in one place. The app automatically categorizes your transactions, making it easy to track your expenses and income.

Some key features of Simplifi by Quicken include:

- Account linking: You can link all your financial accounts to Simplifi, so you can see all your financial information in one place.

- Transaction categorization: Simplifi automatically categorizes your transactions, making it easy to track your expenses and income.

- Budget creation and tracking: You can create a budget in Simplifi and track your spending against it to help you stay on track with your financial goals.

- Bill tracking and payment: Simplifi can track your bills and remind you when they are due. You can also use the app to make payments directly from your linked accounts.

- Goal tracking: Simplifi allows you to set financial goals and track your progress toward them.

- Reports: Simplifi can generate a range of reports, including budget reports, income and expense reports, and investment reports.

- Mobile app: Simplifi offers a mobile app that allows you to access your financial information on the go.

Simplifi by Quicken is a subscription-based service, and it is available on a variety of platforms, including web, iOS, and Android. The app is designed to be user-friendly, with an intuitive interface and easy navigation.

Quicken Pricing

Quicken offers several pricing options, depending on the edition you choose and whether you opt for a subscription or a one-time buy. Here are some details about Quicken’s pricing:

Editions:

- Quicken Starter: This edition is designed for individuals who want to get started with personal finance management. It includes basic features such as account linking, transaction categorization, budget creation, and bill tracking. The cost for this edition is $34.99 for a one-year subscription or $69.99 for a one-time buy .

- Quicken Deluxe: This edition includes all the features of Starter, as well as investment tracking, investment performance analysis, and asset allocation analysis. The cost for this edition is $49.99 for a one-year subscription or $99.99 for a one-time buy .

- Quicken Premier: This edition includes all the features of Deluxe, as well as rental property management and advanced investment tracking features. The cost for this edition is $79.99 for a one-year subscription or $169.99 for a one-time buy .

- Quicken Home & Business: This edition is designed for individuals who want to manage both personal and business finances. It includes all the features of Quicken Premier, as well as business accounting features. The cost for this edition is $99.99 for a one-year subscription or $299.99 for a one-time buy .

Subscription vs. One-time buy :

Quicken offers both subscription and one-time buy options. A subscription gives you access to the latest version of Quicken and provides ongoing updates and support. A one-time buy gives you access to the current version of Quicken, but you will need to buy a new version to receive updates and support in the future.

Quicken also offers a 30-day money-back guarantee on all its products, so if you’re not satisfied with the software, you can request a refund.

Security

Quicken takes security very seriously and has implemented several measures to protect its users’ financial data. Here are some of the security measures that uses:

- Encryption: uses 256-bit encryption to protect users’ financial data during transmission and storage.

- Secure login: requires users to create a strong password and offers two-factor authentication to help prevent unauthorized access.

- Automatic backups: automatically creates backups of users’ financial data, which can be stored locally or in the cloud.

- Secure data storage: stores users’ financial data in secure data centers, which are monitored and protected 24/7.

- Privacy policy: Quicken has a comprehensive privacy policy that outlines how the company collects and uses users’ data.

- Financial institution partnerships: has partnerships with many financial institutions, which allows users to link their accounts directly to. These partnerships are subject to strict security protocols and regulations.

- Customer support: offers customer support to help users resolve security issues or concerns.

It’s important to note that while takes many measures to protect users’ data, no system is completely foolproof. Users should also take steps to protect their own financial data, such as using strong passwords, keeping their computer and software up-to-date, and being cautious when sharing personal information online.

Customer Service

Quicken offers several options for customer service and support. Here are some of the ways you can get help with:

- Quicken Community: has an online community where users can ask and answer questions, share tips and advice, and get help from other users.

- Quicken Support: offers support via phone, email, and chat. Support is available Monday through Friday, from 5:00 am to 5:00 pm Pacific Time.

- Quicken Help Center: Help Center is a comprehensive resource for troubleshooting common issues, finding answers to frequently asked questions, and learning about features and functionality.

- Quicken YouTube Channel: has a YouTube channel where you can find instructional videos and tutorials on how to use.

- Social media: has a presence on several social media platforms, including Twitter and Facebook, where you can get updates, news, and support.

- Quicken Blog: blog is a resource for personal finance tips, news, and updates about products and services.

Omit, Quicken offers a variety of resources for getting help and support with its products. Whether you prefer to get support via phone, email, chat, or online forums, has options to meet your needs.

Technical Requirements

Here are the least system requirements for 2021 for Windows:

Operating System: Windows 10 or newer

Processor: 1 GHz or higher

Memory (RAM): 2 GB or more

Hard Disk Space: 450 MB or more

Check: 1024×768 or higher resolution, 1280×1024 for large fonts

Internet Connection: Broadband recommended for online services and updates

Note that these are the least requirements, and you may need higher specifications depending on the edition of you’re using and the size of your data file. For example, if you’re using Home & Business, which includes business accounting features, you may need a more powerful computer.

It’s also important to keep your computer and software up-to-date with the latest updates and patches to ensure that runs smoothly and securely.

How to Sign Up to Quicken

Here are the steps to sign up

- Click on the “Products” tab on the top navigation menu, and choose the product that you want to sign up for.

- Select your preferred payment plan and click on the “Buy Now” button.

- If you already have a account, log in with your email and password. If you don’t have an account, click on the “Create Account” button to create a new one.

- Fill in your personal information, including your name, email address, and password. You will also need to provide your payment information.

- Review and confirm your order details, and then click on the “Place Order” button.

- After your order is processed, you will be prompted to download and install on your computer.

- Follow the on-screen instructions to install and set up your account.

- Once Quicken is installed and set up, you can start using it to manage your finances.

That’s it! Signing up for Quicken is a straightforward process, and you should be able to get started with the software quickly and easily.

Quicken Alternatives

There are several alternatives to that you can consider for managing your personal finances. Here are some of the most popular ones:

- Personal Capital: Personal Capital is a free online tool that offers investment management services, as well as budgeting and financial planning tools.

- Mint: Mint is a free budgeting tool that helps you track your spending, set financial goals, and create budgets.

- YNAB (You Need A Budget): YNAB is a paid budgeting tool that helps you track your spending, save money, and get out of debt.

- Tiller: Tiller is a paid service that automates your personal finance tracking by integrating with Google Sheets.

- Count About: Count About is a paid tool that offers features like budgeting, account syncing, and transaction tracking.

- PocketSmith: PocketSmith is a paid tool that offers budgeting, forecasting, and calendar-based planning features.

- Moneydance: Moneydance is a paid tool that offers budgeting, investment tracking, and bill payment features.

These are just a few examples of the many personal finance tools available. Each tool has its own unique features and pricing model, so it’s important to test them based on your specific needs and budget.

Pros and Cons

Here are some pros and cons of using Quicken:

Pros:

- Comprehensive financial management: offers a wide range of tools and features to manage your finances, including budgeting, investment tracking, bill payment, and tax preparation.

- Ease of use: Quicken is designed to be user-friendly, with a simple interface and intuitive navigation.

- Customizable reports: allows you to generate customized reports on your financial activity, which can be useful for tracking your spending and identifying areas where you can save money.

- Integration with financial institutions: integrates with thousands of financial institutions, making it easy to track your accounts and transactions in one place.

- Mobile app: has a mobile app that allows you to manage your finances on-the-go.

Cons:

- Cost: Quicken is a paid software, and the cost can add up over time, especially if you need to upgrade to a new version or pay for more features.

- Learning curve: Quicken has a steep learning curve, and it may take some time to get used to all the features and tools.

- Technical issues: Some users have reported technical issues with, such as syncing problems and errors when importing data.

- Limited customer support: While does offer customer support, some users have reported that the support can be slow or unhelpful.

- Data security: Quicken stores your financial data on your computer or in the cloud, which can be a security risk if your computer is hacked or your cloud storage is breached.

Omit, Quicken is a powerful tool for managing your personal finances, but it’s important to weigh the pros and cons and consider your individual needs and preferences before deciding whether to use it.

Also Read About What is Vrbo and How Does it Work?

Frequently Asked Questions :

Quicken tracks your account balances, transactions, investments, personal budgeting, loans, and any other part of your personal financial life. The Home & Business version includes the ability to track rental properties and small businesses in addition to your personal information.

Track & grow your investment portfolio with the most robust tools available. Maximize tax benefits & ease prep with built-in tax reports. Track & pay your bills from Quicken ($119/yr value) Get priority access to customer support ($49/yr value)

Trackable stocks – Up to 2,000 total; Split lines – approximately 250 total per transaction; Paycheck Line Items – 30 total line items per paycheck tracked; Dollar amount – A Quicken file cannot have an entry that is larger than 99,999,999.99.

Conclusion

Quicken is a programme that lets users track their financial transactions, make budgets, and manage investments. It was developed by Quicken Inc.

The several editions of Quicken, such as Starter, Quicken Deluxe, Quicken Premier, and Quicken Home & Business, are all available.

You may use Quicken to connect your financial accounts, including bank accounts, credit cards, and investment accounts, to help you manage your money.

We trust that you have learned something about Quicken from this article. Please let us know in the comments area if you have any questions.