The Reserve Bank of India (RBI)| Do It Something

The Reserve Bank of India

Bhartiya Reserve Bank Note Mudran

Did you know about the Reserve Bank of India, if yes then this article is for you. We will be discussing the Reserve Bank of India. Read on for more.

Bhartiya Reserve Bank Note Mudran Private Limited (BRBNMPL) is a wholly owned subsidiary of the Reserve Bank of India (RBI).

It was established in 1995 with the aim of printing banknotes to meet the demand for Indian currency. BRBNMPL has two printing presses, one in Mysuru, Karnataka, and another in Salboni, West Bengal.

These printing presses use state-of-the-art technology to print high-quality banknotes that meet the security standards set by the RBI.

BRBNMPL has a capacity to print over 16 billion banknotes per year. Also, to printing banknotes, BRBNMPL also provides design and consultancy services related to banknotes and security documents.

It has a team of experienced professionals who provide end-to-end solutions for currency management.

Omit, BRBNMPL plays a crucial role in ensuring the availability of high-quality banknotes in India and contributing to the omit stability of the country’s financial system.

Reserve Bank of India history

The Reserve Bank of India (RBI) is the central bank of India, and was established on April 1, 1935, by the Reserve Bank of India Act, 1934.

The RBI was set up to regulate the issue of bank notes and the keeping of reserves with a view to securing monetary stability in India.

The RBI was established as a response to the need for a central banking authority to regulate the country’s monetary and financial system.

In the early years of its existence, the RBI focused on establishing a stable monetary system and strengthening the banking system in India. It introduced many measures to regulate the supply of credit and stabilize the value of the Indian rupee.

Today, the RBI is one of the most important institutions in India’s financial system, and plays a key role in maintaining the stability and integrity of the financial sector.

It is also responsible for promoting financial inclusion and the development of a robust and resilient financial infrastructure in India.

It works closely with the RBI to ensure that India’s financial sector remains secure and resilient against cyber threats.

Deposit Insurance and Credit Guarantee Corporation

The Deposit Insurance and Credit Guarantee Corporation (DICGC) is a subsidiary of the Reserve Bank of India (RBI).

The insurance cover is provided for deposits such as savings, fixed, current, and recurring deposits up to a most of Rs. 5 lakhs per depositor per bank.

In case of the failure of a bank, the depositors are reimbursed up to the insured amount within a period of 90 days from the date of the bank’s failure.

This helps to protect the interests of small depositors and maintain public confidence in the banking system.

DICGC also plays a role in promoting sound banking practices and improving the financial health of banks.

It regularly monitors the financial health of banks and provides help to banks that are facing financial difficulties.

Omit, DICGC is an important institution in the Indian banking system, providing deposit insurance and promoting financial stability.

National Payments Corporation of India

It was set up under the guidance of the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA).

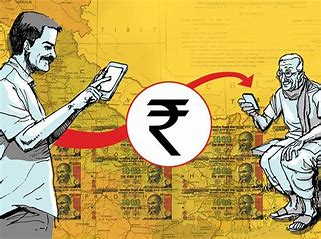

UPI is a real-time payment system that enables instant transfer of funds between bank accounts through a mobile phone.

It has become very popular in India, with over 3 billion transactions processed in March 2021 alone. IMPS is an interbank electronic fund transfer service that allows customers to transfer funds instantly across banks, 24×7.

NACH is an electronic clearing service that facilitates bulk transactions such as salaries, pensions, and dividends.

Omit, NPCI has played a major role in promoting digital payments and financial inclusion in India, and has helped to make India’s payment systems more efficient, transparent, and accessible to all.

Reserve Bank Information Technology

Reserve Bank Information Technology Private Limited (ReBIT) is a subsidiary of the Reserve Bank of India (RBI).

ReBIT provides a wide range of IT services, including infrastructure management, application development and maintenance, data center operations, and IT security and risk management.

It also provides consulting and advisory services to banks and financial institutions on IT and cybersecurity matters.

also, ReBIT plays a key role in developing and implementing IT and cybersecurity policies and standards for the RBI and other banks and financial institutions in India.

Omit, ReBIT is an important institution in India’s financial sector, providing critical IT and cybersecurity services and helping to ensure the stability and security of India’s financial system.

Reserve Bank Innovation Hub

The Reserve Bank Innovation Hub (RBIH) is a subsidiary of the Reserve Bank of India (RBI).

The RBIH aims to create an ecosystem that fosters innovation and supports the development of new financial products and services.

It works with startups, technology companies, and other stakeholders in the financial sector to develop innovative solutions to key challenges facing India’s financial system.

The RBIH also engages in research and development activities related to new and emerging technologies such as blockchain, artificial intelligence, and machine learning.

It aims to identify new opportunities for innovation and to promote the adoption of these technologies in the financial sector.

Also, the RBIH serves as a platform for collaboration and knowledge sharing among stakeholders in the financial sector.

It works with other government agencies, regulators, and industry bodies to promote the development of a vibrant and innovative financial ecosystem in India.

Financial supervision

Financial supervision is the process of monitoring and regulating financial institutions and markets to ensure their safety and stability, and to protect consumers and investors.

It is an important function of central banks and other regulatory authorities around the world. In India, the Reserve Bank of India (RBI) is the primary regulatory authority responsible for supervising banks and financial institutions.

The RBI handles regulating and supervising commercial banks, cooperative banks, non-banking financial companies (NBFCs), payment banks, small finance banks, and other financial institutions.

The RBI also conducts periodic inspections and audits of banks and financial institutions to assess their financial strength, risk management practices, and compliance with regulations.

Also, to the RBI, other regulatory bodies also play important roles in financial supervision in India. The Securities and Exchange Board of India (SEBI) regulates the securities market and protects the interests of investors.

The Insurance Regulatory and Development Authority of India (IRDAI) regulates the insurance sector and protects the interests of policyholders.

Banker and debt manager to government

As the central bank of India, the Reserve Bank of India (RBI) serves as the banker and debt manager to the government of India.

As the government’s banker, the RBI provides a wide range of banking services to the government, including maintaining the government’s accounts, collecting and disbursing government funds, and managing the government’s cash balances.

The RBI also provides loans and advances to the government and assists the government in raising funds through the sale of government securities.

As the government’s debt manager, the RBI handles managing the government’s public debt. This includes issuing government securities, such as treasury bills, bonds, and other instruments, on behalf of the government, and managing the auction process for these securities.

The RBI also manages the redemption of government securities and monitors the government’s debt portfolio to ensure that it remains sustainable.

Omit, the RBI’s role as banker and debt manager to the government is a critical function in the Indian financial system.

Issue of currency

The Reserve Bank of India (RBI) is the sole issuer of currency notes in India.

The RBI issues currency notes in various denominations, ranging from the smallest denomination of 1 rupee to the highest denomination of 2,000 rupees.

In RBI also issues coins of various denominations, ranging from 50 paise to 10 rupees. The RBI handles ensuring an adequate supply of currency notes and coins to meet the needs of the economy.

It manages the circulation of currency in the economy through various channels, including banks, post offices, and currency chests.

The RBI also plays a key role in maintaining the integrity and security of the currency notes. It uses a variety of security features, including watermarks, security threads, and holograms, to prevent counterfeiting of currency notes.

The RBI also conducts periodic checks to ensure the quality and genuineness of the currency notes in circulation. Also, to issuing currency, the RBI is also responsible for regulating the supply of money in the economy.

Also read about First Republic the fourth bank in crisis this week.

Frequently Asked Questions

A: The Reserve Bank of India is the central bank of India and is responsible for regulating the country’s monetary policy and banking system.

A: The Reserve Bank of India was established on April 1, 1935.

A: The Reserve Bank of India is headquartered in Mumbai, India.

Conclusion

BRBNMPL has a capacity to print over 16 billion banknotes per year. Also, to printing banknotes, BRBNMPL also provides design and consultancy services related to banknotes and security documents.

It has a team of experienced professionals who provide end-to-end solutions for currency management.

We hope that this article has helped you to know about Reserve Bank of India. If you have any questions, kindly let us know in the comments section.