What Is Crypto Bull Market [2023] Do It Something

Crypto Bull

Crypto Bull

Did you know about Crypto Bull, if yes then this article is for you. We will be discussing Crypto Bull. Read on for more.

Also Crypto bulls are often seen as enthusiasts who are passionate about the potential of blockchain technology to revolutionize various industries and reshape the financial landscape.

Crypto bulls tend to have a long-term investment strategy, holding onto their cryptocurrency holdings even during periods of market volatility. They believe that the current price fluctuations are simply short-term movements and that cryptocurrencies will eventually gain wider adoption and become more widely accepted to payment.

It’s worth noting that the crypto market is highly speculative and volatile, and there are many factors that can affect the price of cryptocurrencies. So, it’s important for investors to do their own research and consider their risk tolerance before investing in cryptocurrencies.

What is a bull or bear market?

This means that the trend of the market is upward, with investors buying more stocks or other assets than they are selling.

Typically, a bull market is accompanied by strong economic growth, low unemployment, and rising corporate profits.

This means that the omit trend of the market is downwards, with investors selling more stocks or other assets than they are buying.

Typically, a bear market is accompanied by weak economic growth, high unemployment, and falling corporate profits.

What is a cryptocurrency bear market?

A cryptocurrency bear market is a period in which the prices of cryptocurrencies, such as Bitcoin, Ethereum, and others, are generally falling, and there is widespread pessimism about the future prospects of the market. In a bear market, investor confidence is low, and there is a general lack of optimism about the economy and the prospects of cryptocurrencies.

During a bear market, investors tend to be more risk-averse and may choose to exit the market or reduce their exposure to cryptocurrencies.

Additionally, the broader economic and geopolitical conditions can also affect the price of cryptocurrencies and contribute to a bear market.

Bear markets can last for months or even years, and they can be very challenging for investors who hold cryptocurrencies. But, it’s worth noting that bear markets can also present opportunities for long-term investors who are willing to accumulate cryptocurrencies at lower prices and hold them for the long-term.

So, what is a bull market?

A bull market is a financial market in which the prices of securities, such as stocks, bonds, or commodities, are generally rising over an extended period of time. In a bull market, investor confidence is high, and there is optimism about the future prospects of the economy.

Bull markets are often characterized by strong economic growth, low unemployment rates, high corporate profits, and low interest rates, among other factors. This favorable economic environment tends to encourage investors to buy securities, which in turn pushes up their prices.

During a bull market, investors tend to be more willing to take on risk and are often more aggressive in their investment strategies.

What marks the end of a bull market?

Typically, a bull market comes to an end when there is a significant decline in the prices of securities, accompanied by a loss of investor confidence and pessimism about the future prospects of the economy.

There are several factors that can contribute to the end of a bull market, including:

- Economic slowdown or recession: If the economy starts to slow down or falls into a recession, corporate profits may decline, and investor confidence may wane, leading to a sell-off in the stock market.

- Rising interest rates: When interest rates rise, it becomes more expensive to borrow money, which can slow down economic growth and reduce corporate profits. This can also make stocks less attractive to investors, causing a decline in prices.

- Geopolitical events: Geopolitical events, such as wars or political instability, can have a significant impact on the stock market. Uncertainty and instability can cause investors to lose confidence in the market, leading to a sell-off.

- Overvaluation: If stocks become overvalued, meaning that their prices are not supported by the underlying fundamentals, a correction can occur, causing prices to fall.

It’s worth noting that the end of a bull market is not always easy to predict, and market timing can be difficult. It’s important for investors to focus on their long-term investment goals and maintain a well-diversified portfolio, regardless of market conditions.

Definition

A crypto bull believes that the value of digital currencies, such as Bitcoin, Ethereum, and others, will continue to rise in the future.

Crypto bulls often hold a long-term investment strategy and may choose to accumulate cryptocurrencies during market downturns or periods of high volatility. They believe that the current price fluctuations are short-term movements and that cryptocurrencies will eventually gain wider adoption and become more widely accepted to payment.

They may also be active in the cryptocurrency community, attending conferences, participating in online discussions, and promoting cryptocurrencies to their network.

It’s important to note that the crypto market is highly speculative and volatile, and investing in cryptocurrencies comes with significant risks. As with any investment, it’s important to do your own research and consider your risk tolerance before investing in cryptocurrencies.

How long does a bull market last?

The duration of a bull market can vary widely depending on a variety of factors such as economic conditions, geopolitical events, and investor sentiment.

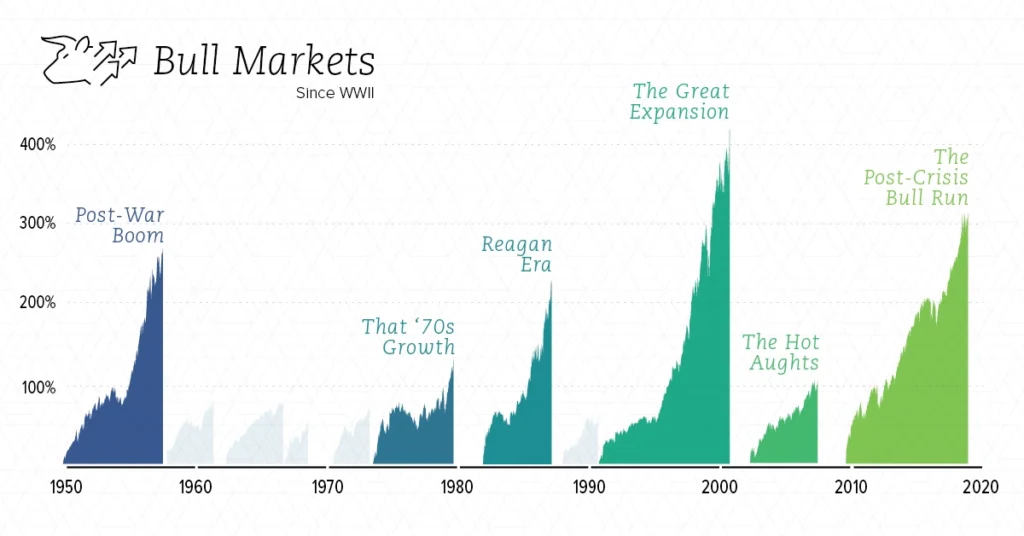

In general, bull markets tend to last longer than bear markets, with the average duration of a bull market lasting around 5 years. But, some bull markets can last much longer, while others may be shorter.

But, the bull market that followed the dot-com bubble in the late 1990s lasted for only a few years before coming to an end in 2000.

It’s worth noting that the length of a bull market is not always a reliable predictor of when it will come to an end. While bull markets tend to follow a cycle of growth and decline, the timing and severity of these fluctuations can be difficult to predict.

Additionally, it’s important to remember that past performance is not indicative of future results, and investing in the stock market always carries risks.

Also read about What Is Bit life

Frequently Asked Questions :

In crypto investing, the term “bullish” refers to positive investor sentiment about digital assets, with such investors commonly called “bulls”. Bullish investors are usually adding to their existing positions with the expectation the forward momentum will continue.

Bull and bear markets are two commonly used terms used to describe prolonged periods of positive and negative market activity. — In the most basic terms, a bull market is a long-term uptrend, while a bear market is a long-term downtrend: but there is more to it than that.

When is the Next Crypto Bull Run Going to Be? Based on empirical market behavior, many experts believe that the next crypto bull run will occur around the time of Bitcoin’s halving event, which is expected to occur in 2024. However, some analysts forecast that the bull run may happen as soon as 2023

Conclusion

This was our guide on Crypto Bull.

Crypto bulls tend to have a long-term investment strategy, holding onto their cryptocurrency holdings even during periods of market volatility.

We hope that this article has helped you to know how to use Crypto Bull. If you have any questions then let us know in the comment section.