What is a Credit Score and Why is it Important?

What is a credit score?

A credit score is a three-digit number that lenders use to assess your ability to pay off a loan, mortgage or card. A higher score means you’re at a lower risk of default and can get better interest rates, lower fees or more cards.

How your score is determined

If you are familiar with Credit Score, you should read this article. Continue reading if you want to learn more about utilizing.

Also, read about What Is The Stop-Go Networks.

Credit scores are calculated using data from your credit report, which contains information about how you’ve handled your bills and debt in the past. Every credit reporting agency has a different way of calculating your credit.

How much you owe: The amount of your total debt, including both existing loans and any new accounts, has the biggest impact on your credit. Lenders are hesitant to lend money to people who have high amounts of debt, and this can lower your score.

Your payment history: Making on-time payments and not filing for bankruptcy can help your score. But missed or late payments and having an account sent to collections can hurt your score.

Length of your history: The longer you have had, the better it will be for your score. But, this category only accounts for 15% of your score.

Types of your accounts: Also called your “credit mix,” this category considers how many instalment and revolving accounts you have.

It’s important to have a variety of different types of credit, including both instalment and revolving accounts, since this shows that you can handle many kinds of credit responsibly.

Factors That Impact Your Credit Score

There are many factors that impact your credit score. These include your payment history, amount of credit you have, how much you owe and the types of accounts you have open.

Your payment history is the most important factor for your credit score and accounts for 35% of the number. This component encompasses your payments on credit cards, retail accounts, instalment loans (such as auto or student loans), finance company accounts and mortgages.

Late payments on these accounts are typically reported to the credit bureaus and can lower your scores. They stay on your report for up to seven years, so it is important to pay your bills on time.

Keeping your balances low on your revolving credit cards, such as your credit card or line of credit, is another important factor for your credit score. It is recommended to keep your credit utilisation ratio (the balance of all revolving lines of credit divided by your total revolving limit) at 30% or less, which is a good percentage for most people.

New Accounts and Hard Inquiries

The age of your oldest account and the average age of all your accounts are other credit-related factors that affect your score. It is recommended to only open new accounts as needed, which will reduce the number of hard inquiries you make on your credit reports.

The number of hard inquiries lenders make when you apply for new credit accounts accounts for 10% of your score. It is also a good idea to avoid opening several accounts at once, especially if your credit history is relatively short to begin with.

Strategies For Improving Your Credit Score – How to Boost Your Score in a Matter of Days

There are a variety of strategies for improving your credit score. Some may take a long time, while others can help you boost your score in a matter of days. The key is to make the most of your resources and follow a plan that works for you.

Strategy 1. Pay on Time and in Full

The largest factor that affects your credit score is your payment history. Missing payments can drag your scores down for years, but keeping on top of your bills can help them stay high.

Use automatic payments or set up alerts to remind you when it’s time to make a payment on your accounts.

Strategy 2. Keep Your Credit Utilization Low

Credit utilisation, also called your revolving debt percentage, makes up 30% of your score. Experts recommend keeping it below 30% to maximise your score.

Strategy 3. Reduce Your Balances

If you have many credit cards, come up with a plan to pay off your balances more quickly. Try the snowball or avalanche methods, which focus on paying off the lowest balances first.

Strategy 4. Disputing Errors on Your Credit Report

If there are errors on your credit report, disputing them with the credit bureau can improve your score. Getting items removed is an important part of improving your credit, but you must dispute them correctly or the information will remain on your report.

Common mistakes to avoid that can negatively affect your credit score

- Late or missed payments: Payment history is a significant factor in calculating credit scores. Late or missed payments can have a significant negative impact on your score.

- Maxing out credit cards: Utilizing a high percentage of your available credit limit can negatively affect your credit. Try to keep your use ratio below 30% to maintain a good score.

- Closing old credit accounts: The age of your credit history is an essential factor in calculating your credit score. Closing old credit accounts can decrease the average age of your credit history and negatively impact your credit score.

- Applying for too many credit accounts: Each time you apply for credit, it creates a hard inquiry on your credit report, which can negatively impact your credit . Too many hard inquiries within a short time frame can say risk and lower your score.

- Co-signing for others: Co-signing a loan for someone else means you are responsible for the debt if the borrower defaults. Any missed or late payments will also be reflected on your report and negatively impact your credit score.

- Ignoring errors on your credit report: Errors on your report can negatively affect your. It’s essential to regularly review your credit report to ensure all the information is accurate and dispute any errors as soon as possible.

How to monitor and track your credit score

Here are some ways to watch and track your credit score:

- Check your credit report: You are entitled to one free credit report from each of the three major credit reporting agencies (Equifax, Experian, and TransUnion) once a year. You can request your credit report at AnnualCreditReport.com.

- Sign up for credit monitoring services: There are several credit monitoring services that can help you keep track of changes to your credit report and alert you to potential fraud. Some popular credit monitoring services include Credit Karma, Experian, and Identity Guard.

- Use a credit score tracking app: There are many apps available that allow you to track your credit score over time. Some popular options include Credit Sesame, CreditWise, and myFICO.

- Check your credit card or loan statements: Your credit score can be affected by missed or late payments, so it’s important to check your card and loan statements regularly to make sure you’re making all your payments on time.

- Set up credit alerts: You can set up alerts with your bank or card company to notify you when there are any changes to your credit score or report. This can help you stay on top of your credit and catch any potential fraud or errors early on.

Understanding the Different Credit Score Models and Their Significance

There are many credit scoring models out there. They are used by lenders to assess a borrower’s creditworthiness and make loan decisions. Each model has its own algorithm and a unique formula that caters to different consumers and different types of lenders.

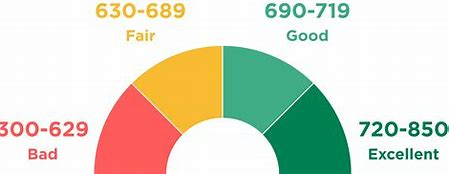

Those algorithms take into account a variety of factors, including payment history, credit utilization, length of credit history and type of credit. Those factors are combined to create a score, which ranges from 300 to 850.

The most common scoring models are FICO and Vantage Score. These two have been around since 1989 and each periodically updates their scoring models to reflect changing factors.

While both models grade credit on a 300 to 850 scale, they differ in how they calculate the scores. For example, FICO scores a mortgage differently than a credit card. They also have different policies on combining similar inquiries into one inquiry.

Other credit scoring models weigh different factors differently, too. For instance, VantageScore gives greater weight to payment history, age and the type of credit you use.

Credit mix: The combination of instalment debt (loans with fixed monthly payments and defined repayment terms) and revolving credit (accounts like credit cards, in which you borrow against a credit limit and make payments in variable amounts). This credit mix handles about 10% of your FICO credit.

Credit scores are important because they can help you decide whether to apply for a mortgage, auto loan or credit card. They can also help you determine the best rates and terms for those loans.

Frequently Asked Questions

A credit score is a three-digit number that reflects your creditworthiness based on your credit history. It is used by lenders, banks, and credit card companies to assess your risk as a borrower and determine your eligibility for credit.

Credit scores are calculated using a variety of factors, including your payment history, credit utilization ratio, length of credit history, types of credit accounts, and recent credit inquiries. The most common credit score models are FICO and Vantage Score, but there are other scoring models used by different lenders.

Credit scores typically range from 300 to 850. A good credit score is generally considered to be 670 or higher. However, what is considered a good credit score may vary depending on the lender and the type of credit you are applying for.

Conclusion

This was our guide on the credit score.

In conclusion, monitoring and tracking your credit score is an important aspect of managing your finances.

By regularly checking your credit report, using monitoring services, and setting up credit alerts, you can stay on top of any changes to your and detect any potential fraud or errors early on.

It’s also essential to avoid common mistakes that can negatively affect your credit score, such as late or missed payments, maxing out cards, and applying for too many credit accounts.

By taking these steps, you can improve your credit score over time and maintain a healthy financial profile.

Leave a Reply