How To link Aadhaar Card To PAN Card: Step-By-Step Guide |

link Aadhaar Card To PAN Card

- Check if your Aadhaar and PAN details match:

- Visit the Income Tax Department website:

- Click on “Link Aadhaar” under the Quick Links section:

- Enter your PAN and Aadhaar details:

- Verify the details:

- Confirmation of the linking process:

- Check the status of Aadhaar-PAN linking:

Check your Aadhaar and PAN card details:

If you are familiar with the link Aadhaar Card To PAN Card, you should read this article. Continue reading if you want to learn more about utilizing.

If you are an Indian citizen, then it is important to check your Aadhaar and PAN card details regularly. This is a good practice because you can use these documents as proof of identity or address while applying for services and benefits.

Check out our most recent tutorial on MarketCall Affiliate Program.

The Aadhaar Card is an initiative taken by the government to ensure that all citizens have a unique identification number. This number is linked to different government institutions and can be used to establish identity multiple times. This makes it easier to get services from the government, such as opening bank accounts, driving licenses, and passports.

In case you have not yet linked your Aadhaar and PAN cards, you should start doing it now. Getting it done before March 31, 2023, will help you avoid any hassles in the future and save money in the long run.

Linking your Aadhaar and PAN is a mandatory process for individuals and businesses that are required to file income tax returns. However, many people are still unaware of this requirement.

As per a recent notification, the income tax department requires all PAN card holders to link their Aadhaar numbers to their tax filings. This is done through the Income Tax e-Filing Portal.

You can check whether your PAN card is linked to your Aadhaar or not by logging into the portal. The process is quite easy and simple. Once you are logged in, a pop-up window will appear on your screen mentioning the linking of your PAN with your Aadhaar. Alternatively, you can also go to your profile settings and click on ‘Link Aadhaar’.

Visit the Income Tax e-Filing website:

- Open a web browser such as Google Chrome, Mozilla Firefox, or Internet Explorer.

- In the address bar of the browser, type www.incometaxindiaefiling.gov.in and press Enter.

- You will be directed to the homepage of the Income Tax e-Filing website.

- If you are a registered user, enter your User ID (which is your PAN card number) and password to log in to your account.

- If you are a new user, click on the “Register Yourself” option and follow the instructions to create a new account.

- Once you are logged in, you can access various services such as filing income tax returns, checking tax credit status, and linking your Aadhaar card to your PAN card.

Also, Read About, Rainmaker Network Affiliate program.

Click on “Link Aadhaar” under the Quick Links section:

To link your Aadhaar card to your PAN card, you can follow these steps:

- Visit the Income Tax e-filing website at https://www.incometaxindiaefiling.gov.in/home.

- Click on the “Link Aadhaar” option under the “Quick Links” section on the left-hand side of the homepage.

- Enter your PAN number, Aadhaar number, and name as per your Aadhaar card.

- If only the birth year is mentioned on your Aadhaar card, then tick the square box.

- Enter the captcha code and click on the “Link Aadhaar” button.

- A pop-up message will appear stating that your Aadhaar card has been successfully linked with your PAN card.

By following these steps, you can link your Aadhaar card to your PAN card. It is important to link both documents, as it is mandatory for filing income tax returns in India.

Enter your PAN and Aadhaar card details:

To link your Aadhaar card with your PAN card, you need to follow the steps given below:

- Visit the Income Tax e-filing website at https://www.incometaxindiaefiling.gov.in/home.

- Click on the “Link Aadhaar” option under the “Quick Links” section on the left-hand side of the homepage.

- On the next page, enter your PAN number, Aadhaar number, and name as per your Aadhaar card.

- If only the birth year is mentioned on your Aadhaar card, then tick the square box.

- Enter the captcha code.

- Click on the “Link Aadhaar” button.

- A pop-up message will appear stating that your Aadhaar card has been successfully linked with your PAN card.

By following these steps and entering your PAN and Aadhaar card details correctly, you can link both documents easily.

Verify the details:

To verify your details after linking your Aadhaar card with your PAN card, you can follow these steps:

- Visit the Income Tax e-filing website at https://www.incometaxindiaefiling.gov.in/home.

- Click on the “Profile Settings” tab and select “My Profile” from the dropdown menu.

- Under “My Profile”, you will find an option to “View/Verify Aadhaar Details”. Click on this option.

- You will be redirected to the UIDAI website. Here, enter your Aadhaar number and captcha code and click on “Send OTP” to receive an OTP on your registered mobile number.

- Enter the OTP and click on “Submit”. Your Aadhaar details will now be displayed on the screen.

- Similarly, you can click on “View/Verify PAN Details” under “My Profile” to verify your PAN card details.

By following these steps, you can verify the details of both your Aadhaar and PAN card after linking them. It is important to ensure that your details are correct and up-to-date, as they are used for various financial and official purposes.

Confirmation of the linking process:

To confirm the linking process of your Aadhaar card with your PAN card, you can follow these steps:

- Visit the Income Tax e-filing website at https://www.incometaxindiaefiling.gov.in/home.

- Click on the “Profile Settings” tab and select “Link Aadhaar” from the dropdown menu.

- On the next page, enter your PAN number and Aadhaar number to check the status of the linking process.

- Enter the captcha code and click on the “View Link Aadhaar Status” button.

- A pop-up message will appear stating whether your Aadhaar card is linked to your PAN card or not.

If your Aadhaar card and PAN card are linked, you will receive a confirmation message stating “Your Aadhaar is already linked with PAN”. If they are not linked, you can follow the steps provided to link them. It is important to ensure that both documents are linked, as it is mandatory for filing income tax returns in India.

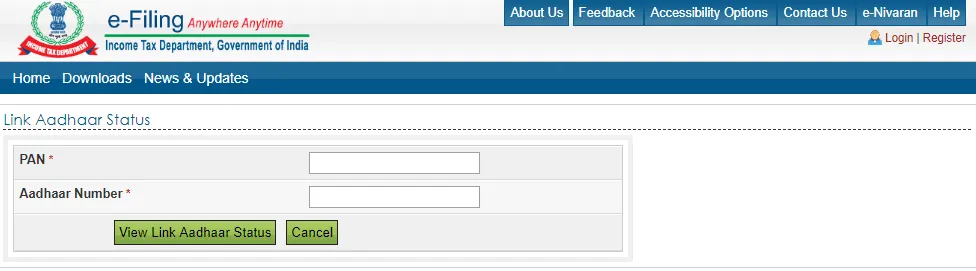

Check the status of Aadhaar-PAN linking:

To check the status of Aadhaar-PAN linking, you can follow these steps:

- Visit the official website of the Income Tax Department at https://www.incometaxindiaefiling.gov.in/home.

- Click on the “Link Aadhaar” option under the “Quick Links” section on the left-hand side of the homepage.

- On the next page, scroll down to find the option “Check Aadhaar-PAN linking status” and click on it.

- Enter your PAN and Aadhaar numbers in the respective fields.

- Enter the captcha code and click on the “View Link Aadhaar Status” button.

- A pop-up message will appear stating whether your Aadhaar card is linked to your PAN card or not.

If your Aadhaar card and PAN card are linked, you will receive a confirmation message stating “Your Aadhaar is already linked with PAN”. If they are not linked, you can follow the steps provided to link them. It is important to ensure that both documents are linked, as it is mandatory for filing income tax returns in India.

Also, Raed About,

Once you have linked your Aadhaar and PAN, a QR code will be printed on the card. This will carry your details, which you can scan using your mobile phone to verify the information.

It is essential to ensure that your name, date of birth, and gender are correct in both documents. Otherwise, the linking process will fail and you will have to make corrections in both the Aadhaar and the PAN databases.

During the verification of your Aadhaar and PAN details, a Time Password (OTP) will be sent to your registered mobile number. You can then enter the OTP to complete the linking process.

If you have a valid Aadhaar and PAN card, the process will be completed in less than a minute. You will receive a confirmation email or SMS after the process is done.

Frequently Asked Questions:

You can do online linking of the Aadhaar number with your PAN by logging on to the income tax e-filing portal. You can also do it through SMS. There are three ways of linking your PAN to an Aadhaar: 1. Linking of an Aadhaar Number and PAN via SMS 2. Without logging in to your account (2-step procedure) 3. Logging in to your account (6-step procedure)

The Link Aadhaar service is available to individual taxpayers (both registered and unregistered on e-Filing) who have a valid PAN and Aadhaar number. With this service, you can: Pre-login on the e-Filing homepage (for both registered and unregistered users)

The PAN–Aadhaar linking date has been extended from 31st March 2022 to 31st March 2023. The final day to link PAN and Aadhaar without paying a fine, however, was March 31, 2022. Now, a fine of Rs. 1,000 must be paid for linking PAN-Aaadhaar.

You should use your Aadhaar without any hesitation for proving your identity and doing transactions, just like you use your bank account number, PAN card, debit card, credit card, etc., wherever required.

Conclusion

Using this as a guide – link Aadhaar Card To PAN Card.

Linking your Aadhaar card with your PAN card is a simple process that can be completed online through the Income Tax e-filing website. It is mandatory for taxpayers to link their Aadhaar and PAN cards to file income tax returns in India.

By linking both documents, you can ensure that your details are up-to-date and accurate, making it easier to file your tax returns and complete other financial transactions. Remember to verify your details and check the status of the linking process to ensure that it has been completed successfully.

This article should have made it clear to link Aadhaar Card To PAN Card. Please let us know in the comments area if you have any questions.