Understanding Different Types of Loans Available| Do It Something

Understanding the Different Types of Loans Available

Introduction

This post is for you if you are familiar with the Loans. Read on for more information on this subject.

Also, read about What Is The Stop-Go Networks.

Loans are a type of financial transaction where one party, usually a lender such as a bank or financial institution, gives money to another party, usually a borrower, with the expectation that the borrower will repay the loan amount with interest over a set period of time.

Also Loans can be used for a variety of purposes such as buying a home, purchasing a car, starting a business, or paying for education.

Loans are typically repaid in instalments over a set period of time, and failure to make payments on time can result in penalties or even default.

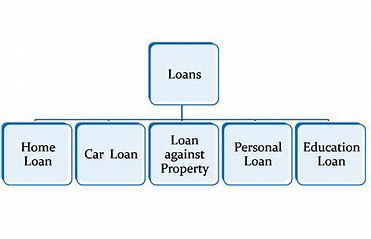

Type of Loans

There are many types of loans available, and they can be broadly categorised as follows:

- Personal loans – These are typically unsecured loans that can be used for a variety of purposes such as debt consolidation, home improvements, or medical expenses.

- Business loans – These are loans specifically designed for businesses to fund operations, buy equipment, or expand their operations.

- Student loans – These are loans used to pay for education expenses such as tuition, books, and living expenses.

- Mortgage loans – These are loans used to buy a home or real estate property. They are typically secured loans that use the property as collateral.

- Auto loans – These are loans used to buy a vehicle. They are typically secured loans that use the vehicle as collateral.

- Payday loans – These are short-term loans that are typically used to cover emergency expenses. They typically have high interest rates and fees.

- Secured loans – These are loans that need collateral such as a car or home to secure the loan amount.

- Unsecured loans – These are loans that do not need collateral and are typically based on the borrower’s creditworthiness.

- Consolidation loans – These are loans used to join many debts into a single loan with a lower interest rate and monthly payment.

Interest Rates – A Subheading About Interest Rates

Interest rates – A subheading about interest rates could cover topics such as what an interest rate is, how to calculate them and whether they’re a good thing or a bad thing for your finances.

An interest rate is the amount that a lender charges a borrower for taking out a loan. It can also be expressed as an annual percentage of the amount loaned, called an APR (annual percentage rate).

The Fed regulates the federal funds interest rate, which is the monetary rate that banks use to set the cost of credit for consumers. They do this to help control the economy by raising or lowering interest rates in response to the state of the market and the inflation outlook.

When interest rates are low, banks may make more money on loans and deposit accounts. But these low rates are also bad for anyone saving or investing because it means that they won’t see much in return.

But, when interest rates are high, they can have positive effects on savers. Banks tend to raise the interest they pay on savings and fixed income securities over time as rates rise.

Moreover, higher interest rates mean that regular benefits and entitlement payments are also going up. This is because they’re indexed to inflation.

Ultimately, the market wants a moderate level of rates that are steady and predictable. That way, it can keep a healthy balance between growth and inflation in the economy.

Loan Terms

Loan terms refer to the conditions of a loan agreement, including the repayment period, interest rate, and other details. Here are some common loan terms:

- Repayment period – The length of time over which the loan is to be repaid. This can range from a few months to several years depending on the loan type and amount.

- Interest rate – The percentage of the loan amount that the borrower will pay as interest over the loan term. This can be fixed or variable, and may be influenced by factors such as creditworthiness, collateral, and market conditions.

- Principal – The amount of money that is borrowed and needs to be repaid, excluding interest and fees.

- Fees – Some loans may include various fees such as origination fees, prepayment penalties, or late fees.

- Collateral – Loans that are secured may need the borrower to put up collateral such as a car or home as security in case of default.

- Payment schedule – The frequency and amount of payments that the borrower needs to make to repay the loan, which can be monthly, bi-weekly, or weekly.

- Grace period – The period before repayment is due during which the borrower is not required to make payments.

- Prepayment – The ability of the borrower to make more payments towards the loan principal before the due date, which can reduce the total interest paid over the loan term.

- Default – The failure of the borrower to make payments on time or according to the loan agreement, which can result in penalties, legal action, and damage to the borrower’s credit score.

Credit Scores – How They Affect Your Loan

Credit scores – A section on credit scores could cover how they affect loan approvals, rates, and terms.

A credit score is a three-digit number that lenders use to judge how likely you are to repay your debts. A high credit score means you’re a low risk to them and can get better loan terms.

Credit Scores – How They Affect Your Loan

Lenders use credit scores to decide if they’re willing to extend you credit, including loans and credit cards. They’ll consider factors such as your income and savings, but also your past credit history, which is based on information contained in your credit report.

The most common scoring model is the FICO score, developed by Fair Isaac Corporation (FICO), but there are several others. They all use different formulas, but they all attempt to calculate how likely you are to pay your debts in full.

Your payment history is 35 percent of your score, and it’s important to make all your payments on time. Late payments, especially if they’re recent and frequent, can hurt your score.

Other things that impact your score include the amount you owe, how much is available, and whether you’re carrying large balances on revolving credit. Your length of credit history is 15 percent of your score, and the longer it is, the higher it is.

If you’re thinking about applying for a new loan or credit card, it’s best to wait until your credit score is as high as possible, which helps to mitigate risk to the lender.

You can do this by checking your credit report and paying off any accounts that aren’t in good standing. You can also work to improve your credit mix, which shows lenders if you have both instalment and revolving credit, such as a car or mortgage loan.

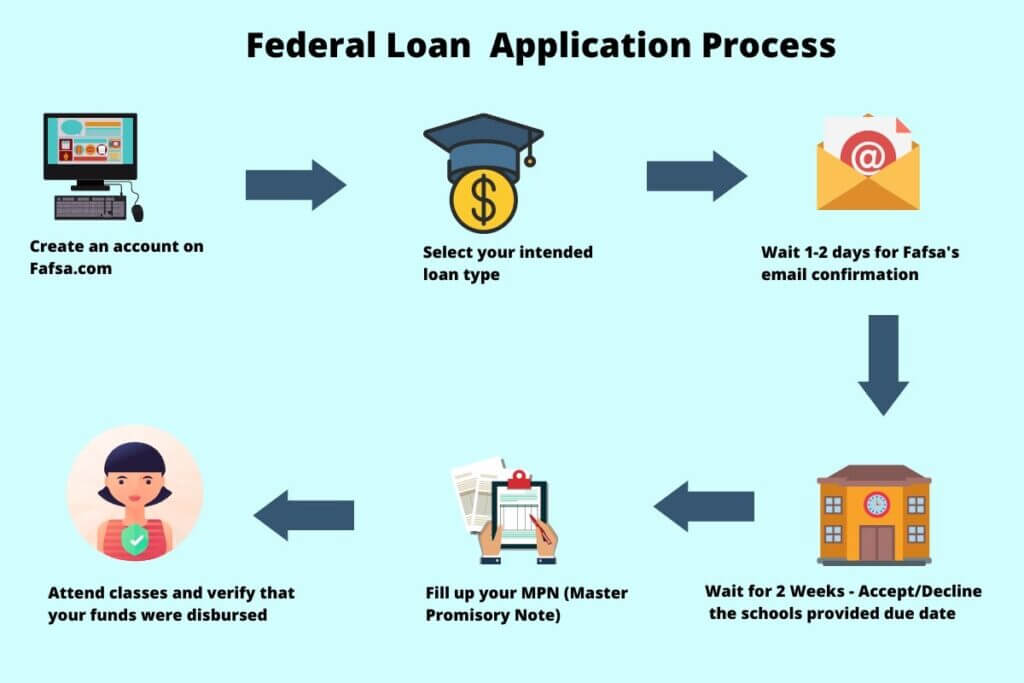

Loan Application Process – This Could Cover What Documentation is Required

There are many things that go into a loan, but the basic process is like any other financial transaction. Whether it’s a business loan or a personal loan, lenders typically need documentation to ensure they can be confident about your ability to pay back the funds.

Credit Scores

Your credit history is one of the most important factors a lender considers when considering your application for a loan. Typically, lenders want to see a least credit score of around 600.

Employment/income

Lenders are also interested in your past and current employment and income. This information is critical in determining your loan eligibility, and it’s common for lenders to call employers to verify your earnings.

Down payment and investment documents (if you’re getting a home loan): You may be asked to provide proof of the source of your down payment, including investment or savings account statements that show at least two months of ownership. If some of the down payment was a gift, you’ll need documentation of that as well.

Other documents that are sometimes requested by lenders include your driver’s licence and social security card. These are used to verify your identity and match your social security number with your picture ID, which helps your lender ensure you’re the person applying for a loan.

Having this information ready can help you prepare for your initial meeting with your lender and make sure you’re prepared to answer any questions they might have.

This will also help you stay focused on the process and avoid any potential misunderstandings that can lead to delays in your loan approval.

Loan Repayment – A Subheading Could Cover Information About Making Payme Work For You

Loan repayment – This subheading could cover information about making payme one of the best payments apps out there, which has several advantages that could help you out in your day to day life.

Using the app makes it much easier to make cashless payments, whether splitting the bill in a restaurant or buying that new dress you’ve been eyeing for months.

Besides being a convenient way to pay, the app also offers some cool social features like the ability to share your payments with your friends.

The app’s other cool features include a mashup of different payment options including credit cards, cash, mobile wallet and e-money. The app even lets you track your spending with a handy dashboard that includes aspen log’ and money balance’.

Choosing the right app to make your payments could save you money on interest and other charges. It’s always a good idea to compare the options, to see what works best for you.

The most important thing is to understand your financial situation, and how your options fit in with your lifestyle.

FAQ- Loans

A loan is a financial transaction in which a borrower receives money from a lender with the understanding that it will be paid back with interest.

There are many types of loans available, including personal loans, car loans, home loans, business loans, student loans, and more.

The interest rate on a loan varies depending on the lender, the borrower’s credit score, and the type of loan. Generally, the better your credit score, the lower your interest rate will be.

Conclusion

In conclusion, loans are a common financial product that allow borrowers to receive money from lenders with the agreement to pay it back over time, typically with interest.

There are many different types of loans available, including personal loans, business loans, student loans, mortgage loans, and auto loans.

It is important for borrowers to carefully consider their options and understand the terms and conditions of any loan agreement before taking out a loan.